When U.S. small and medium-sized enterprises (SMEs) thrive, they create jobs, strengthen local economies, and drive innovation. For one Brazilian finance professional, helping these businesses access the capital and financial tools they need has been the mission of his career.

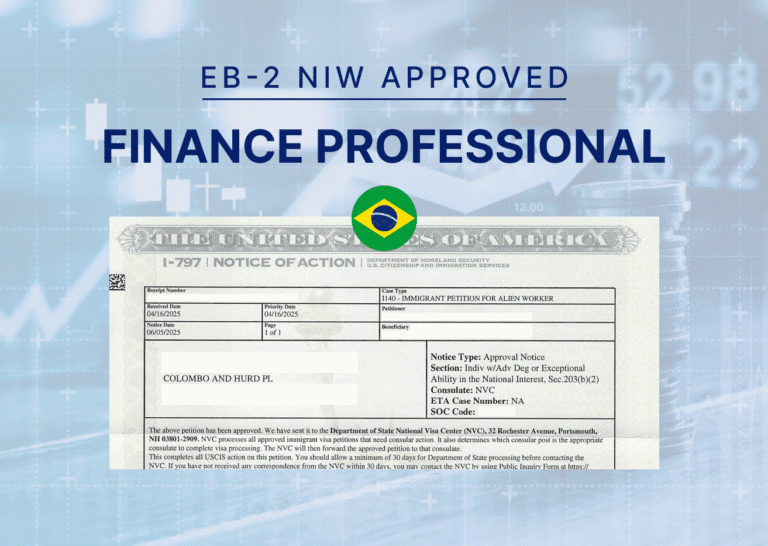

Colombo & Hurd Immigration Attorney Jason Qiu recently secured EB-2 NIW approval for a Brazilian finance professional whose mission centers on empowering America’s small and medium-sized business sector. Business and finance professionals can successfully navigate the EB-2 National Interest Waiver (NIW) pathway when they demonstrate that their expertise addresses critical economic needs.

Our client creates tailored financial solutions that empower U.S. SMEs to secure the capital and tools needed for sustainable growth

Our client, a finance and business administration professional from Brazil, combined strong academic training with extensive U.S. industry experience. With a bachelor’s degree in finance, an MBA from a leading U.S. university, and seven years of progressive experience in the American financial sector, he built a career focused on capital raising, mergers and acquisitions, and complex financial structuring.

As a FINRA-registered investment banker, he earned recognition within the U.S. financial system, working directly with companies to solve pressing challenges around liquidity and access to credit. His proposed endeavor grew out of this experience: creating tailored financial solutions that empower U.S. small and medium-sized enterprises (SMEs) to secure the capital and tools needed for sustainable growth.

As Attorney Jason Qiu noted:

“Given this client’s qualifications, specialized skillset, and the nature of his long-term professional objectives, our legal team recognized EB-2 NIW as the best option for his profile, allowing him to self-petition without needing a specific job offer.”

While the client’s credentials were strong, the central challenge was to demonstrate how his work rose beyond private consulting to a matter of national importance. SMEs are often underserved in the financial marketplace, yet they remain the backbone of the U.S. economy. The key was to frame his endeavor as one that went beyond helping individual clients and strengthening the entire SME sector and, by extension, U.S. economic resilience.

As Mr. Qiu explained:

“We focused on multiple key areas that demonstrated the national impact of the client’s endeavor. A critical linchpin of our strategy was to connect the client’s expertise to broader economic policy objectives, particularly established federal priorities regarding building a competitive, resilient, and prosperous SME sector as codified in the Small Business Act. This alignment with more permanent federal objectives, rather than temporary initiatives, strengthened the national importance argument.”

To present the client’s case, our team emphasized what made his profile distinctive: his ability to bridge advanced financial theory with real-world application for U.S. businesses. Beyond highlighting his credentials, we told the story of a professional who had seen firsthand how American SMEs often lack the sophisticated financial tools available to larger corporations, and how he was uniquely positioned to close that gap.

We demonstrated how his proposed endeavor would directly support the financial health of U.S. SMEs through enhanced financial tools and advisory support aimed at strengthening their foundations, promoting sustained profitability, and overcoming the capital access barriers that so often prevent growth. By referencing initiatives from the SBA, EDA, and other federal programs, we showed how his work aligned with national priorities designed to strengthen small business competitiveness.

We also emphasized his extensive U.S. experience in mergers, acquisitions, and complex financial products. His professional standing was reinforced by support letters from industry experts who attested both to his record of success and the prospective impact of his work. To further solidify the case, we presented a strong and concrete plan that clearly outlined his methodologies, future objectives, and support from a U.S. financial services institution that saw direct value in his approach.

Attorney Jason Qiu reflected on the strategy this way:

“We focused on multiple key areas that demonstrated the national impact of the client’s endeavor. A critical linchpin of our strategy was to connect the client’s expertise to broader economic policy objectives, particularly established federal priorities regarding building a competitive, resilient, and prosperous SME sector as codified in the Small Business Act. This alignment with more permanent federal objectives, rather than temporary initiatives, strengthened the national importance argument.”

Finally, the petition itself was designed to tell a clear and compelling story. The evidence was presented in a cohesive way that tied his unique background to urgent national priorities, resulting in approval without a Request for Evidence (RFE).

Wondering if You Qualify?

Your background may align with the requirements for the EB-2 NIW.

EB-2 NIW Petition Approved

USCIS approved the EB-2 NIW petition, securing for our client a pathway to permanent residence without the need for a job offer or labor certification process. This approval validates the strategic approach of positioning advanced financial expertise as a matter of national interest when directed toward addressing the systematic financing gaps that constrain small business growth.

Mr. Qiu shared valuable insights about what this approval means for other business and finance professionals considering the EB-2 NIW route:

“America’s small and medium-sized enterprises often operate without access to the sophisticated financial tools available to their larger counterparts, creating an uneven playing field in the marketplace. This successful outcome demonstrates that professionals in business and finance can effectively navigate the EB-2 NIW landscape when their expertise directly addresses these critical gaps in the American economy. By focusing on the national importance of supporting America’s small business infrastructure, the client successfully established that his contributions serve broader national interests.”

For additional insights into leveraging SME-focused work for EB-2 NIW cases, explore our comprehensive guide: How Supporting Small and Medium Enterprises (SMEs) Can Strengthen Your EB-2 NIW Case.

“This successful outcome demonstrates that professionals in business and finance can effectively navigate the EB-2 NIW landscape when their expertise directly addresses these critical gaps in the American economy. By focusing on the national importance of supporting America’s small business infrastructure, the client successfully established that his contributions serve broader national interests.”