Insurance Operations Specialist

The U.S. insurance industry plays a crucial role in economic stability, yet it faces growing pressure due to rising claim costs, inflation, cyber risk, and increasing regulatory demands. To remain resilient and competitive, the industry must modernize its processes and adopt smarter technology strategies.

With this goal in mind, a Peruvian business professional with an MBA developed a project to improve the performance of U.S. insurance companies. His proposed endeavor focuses on modernizing claims operations, optimizing vendor selection, and strengthening compliance through System Integration Testing (SIT) and User Acceptance Testing (UAT), methods designed to improve system performance and reduce operational risk.

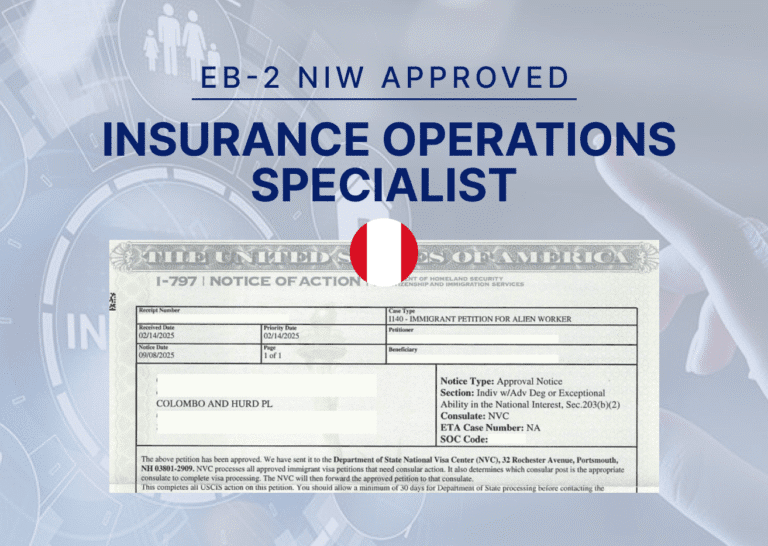

During the review of his EB-2 National Interest Waiver (NIW) petition, USCIS issued a Request for Evidence (RFE) asking for more proof of the national importance of his work. With the guidance of Colombo & Hurd Attorneys Diego Menendez and Paul Messina, his petition was approved on September 8, 2025, just six months and 25 days after filing.

Driving Innovation and Efficiency Across the Insurance Landscape

With over 20 years of experience in financial services, our client has focused his career on improving how insurance companies operate. He has worked to simplify complex processes, reduce system errors, and introduce technology that supports accurate and compliant decision-making.

Originally from Peru, he holds a Bachelor’s degree in Business Administration and a Master of Business Administration (MBA). He has experience in both the insurance and banking sectors, which has given him a strong foundation in regulated industries that demand compliance, precision, and strategic planning.

Attorney Diego Menendez highlighted one of the strengths of the case, noting: “What made him stand out was his combination of corporate leadership and hands-on transformation work. He didn’t just design strategies, he implemented them. We were able to show measurable results linked directly to his methods.”

Now, he plans to continue this trajectory in the United States by helping insurers modernize legacy systems, improve claims processing, and adopt scalable technology solutions that enhance customer service and compliance.

Overcoming Questions of National Importance and Industry Impact

USCIS issued a Request for Evidence (RFE) requesting more proof of national importance, evidence that he was well positioned to advance his plan, and justification for waiving the job offer requirement.

A key challenge was explaining the nature of his field. His work in organizational transformation and system modernization for insurance companies is technical and not widely understood by immigration officers. As Mr. Menendez explained, “organizational transformation in insurance isn’t easily understood outside the industry,” so the response needed to show how the petitioner’s work solves real efficiency and compliance challenges in the U.S. insurance sector.

The RFE also included an error, misclassifying him as a Senior Silicon Design Engineer, a field unrelated to his background. The legal team corrected this and clarified his actual expertise in insurance operations and system modernization.

USCIS further questioned whether he had traction in the U.S. market. According to Mr. Menendez, “we had to capture the momentum he had already built in the U.S., including interest from potential clients,” and present it as evidence of readiness, not intention.

Finally, the RFE questioned “the originality and impact of his contributions”, explained Mr. Menendez, so the legal strategy focused on connecting his results abroad to specific gaps in U.S. insurance operations, demonstrating direct national benefit.

A Strategic and Evidence-Based Approach

Colombo & Hurd prepared a structured and persuasive response to the RFE. The first step was correcting USCIS’s classification error and clearly defining his field as insurance operations strategy and digital transformation.

The legal team then demonstrated that his project aligns with U.S. national priorities by referencing: The Dodd-Frank Act, FDIC modernization guidelines and Texas Department of Insurance Strategic Plan. These references showed that his work directly supports financial system modernization, risk reduction, and regulatory compliance, which are priority areas for the United States.

According to Mr. Menéndez, “we were able to connect his prior results abroad with how those same innovations address gaps in U.S. insurance operations.”

Mr. Menéndez underscored the professional integrity of the client: “He is a humble professional who focuses on solving problems rather than promoting himself. Our job was to help USCIS see the value he was already delivering.” Colombo & Hurd organized his career evidence in a clear, objective way, without exaggeration, using expert analysis, documented case results, and evidence of industry interest to confirm his strong position in the field.

See if you qualify

Get your free EB-2 NIW visa profile evaluation today.

Approval Through Strategy and Expertise

USCIS approved the EB-2 NIW petition on September 8, 2025. Mr. Menéndez shared that the most rewarding part of the case was helping the client’s professional story come to life. He explained that the petitioner was genuinely motivated to help U.S. companies become more agile, resilient, and sustainable, and that his work blended business strategy, risk management, and practical problem-solving.

With approval granted, our client will now continue helping insurance companies upgrade core systems, improve regulatory compliance, and increase efficiency through technology-driven solutions in the EE.UU. This case demonstrates how clarity, preparation, and strong legal advocacy can turn a complex RFE into a successful immigration outcome.

Interested in finding out if an EB-2 NIW could support your goals? Start with a free evaluation here.

“We advocated aggressively so he could contribute fully, create jobs, and help strengthen a critical U.S. industry,” he said, noting that what made the client particularly compelling was his global perspective. Having led transformation initiatives across several countries, the petitioner had learned to adapt best practices to different regulatory environments, demonstrating exactly the kind of innovation and leadership that benefits the United States.